When you enter a Source Name, QuickBooks® copies that name into any Target Name that you leave blank. When you make a journal entry in QuickBooks® with Accounts Receivable/Accounts Payable as the first line item and assign a Customer/Vendor Name to that line, each subsequent line uses that Name even if you leave it blank. According to the article above, you will need to credit the payroll liabilities (employee taxes) and debit payroll expenses (employer taxes) when creating a Journal Entry. The Paychex processing admin fee isn't part of the employee liabilities but it's an employer expense. Explore our payroll packages to find the solution that best fits you and your business. Looking for a payroll solution that will match your business needs? Compare payroll packages and find one that works with you business size & budget. I’m trying to import a simple list from Excel into QuickBooks and have QuickBooks turn that list into separate invoices. The list in Excel includes customer name, service type, description, cost, quantity, etc. (with each customer on a new line).

Payroll Journal Entry for QuickBooks Desktop In this article • • • For that do not subscribe to one of, you may follow the below examples to help you record your payroll transactions back into your desktop version of QuickBooks. Journal Entry The most common way to enter payroll into QuickBooks is via a general Journal Entry. To help streamline this process; -First set up a 'Memorized Transaction' in QuickBooks. For how to create a simple memorized transaction for payroll. -Next follow which will show you how to Enter a Payroll using the memorized transaction you just created. Custom Import File.

All payroll clients have the option of receiving a customized GL Report and/or that is mirrored/matched directly with their Chart of Accounts. This custom file can be imported directly into a desktop version of QuickBooks.

To get started, please share a sample journal entry and/or a copy of your chart of account with your account manager. You will not have to sit coding fields and mapping lines of entries; our experienced staff will work with your accounting team to format the report to suit your needs for import. If you do not use QuickBooks, we can export files to match a number of other accounting software. Contact us directly to set up your custom report.

Other Tips Net Vs. Gross Payroll - Keep in mind, it is key to understand the different between gross and net payroll.

Novel writing software for mac. Gross payroll is the total amount you pay your employees BEFORE deductions. Net payroll is what you pay your employees AFTER deductions. This can be a mixture of payroll expenses and liabilities such as taxes, health benefits, 401(k) contributions, etc.

Accounting Method; - Consult with your accountant on how you should be entering and dating your payroll entry. For example, if you use an Accrual Based accounting practices you would date your payroll entry on the pay period end date. Whereas if you use a Cash Based you would date your payroll entry as the check date. Did that address your question?

If not, Last updated on October 9, 2017 Related Articles • • • • Toggle Search.

Payroll tax returns have been prepared and filed showing no balance due (and no notices to the contrary have been received) Payroll, (and inventory discussed elsewhere), are two areas where ® is less forgiving and clients are more likely to make mistakes. Most often the errors are the result of incorrect or inconsistent procedures. The most common error in this area is that the Pay Payroll Liabilities feature was not used; rather payroll tax payments were entered using Write Checks or Enter/Pay Bill functions. Common Error: Clients Write Checks (or use check register) to pay payroll tax liabilities. Symptoms: • Payroll Liabilities are higher than expected • Payroll Tax Expense is higher than expected • Bank account balance appears correct Warnings Reduce Errors QuickBooks does warn users in several instances when the recommended procedures are not followed. If users heed the warnings, errors are often avoided.

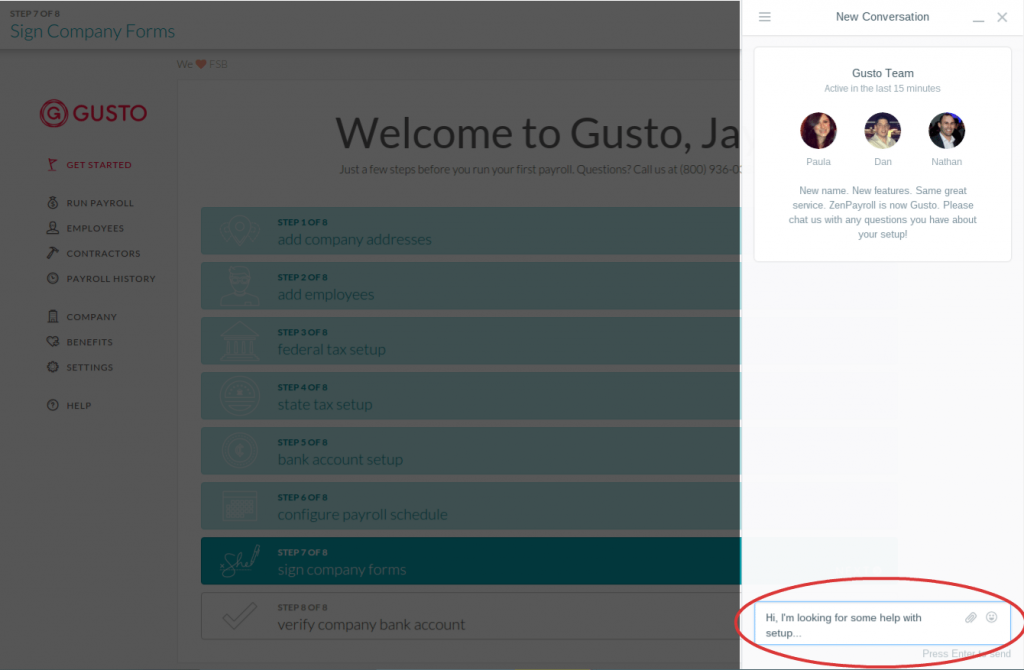

However, some users will click past these warnings and still process the payroll incorrectly perhaps for a lack of understanding as to how to do otherwise. A client must first subscribe to one of Intuit’s payroll offerings for payroll to be established. Once payroll is installed, a Payroll Setup Tool walks the client through the process. QuickBooks payroll works best when all payroll activity is performed from within the payroll menus.

This includes paying accrued payroll taxes to the respective taxing authorities. If the company has written checks or used the Enter/Pay Bills entered bills functionality to pay for these liabilities, and the QuickBooks-created Payroll Liabilities account was assigned, the following warning message appears: This message warns but does not prevent users about using the wrong type of payment (i.e., Write Checks or Enter/Pay Bills) when attempting to make payroll liability payments. When the user clicks the Pay Payroll Liabilities button in the warning message, the user is directed to the Select Date Range for Liabilities dialog. The message directs the user to use the Pay Payroll Liabilities feature to create a payroll liability check. Find Incorrectly Paid Payroll Liabilities In the Client Date Review, the Find Incorrectly Paid Payroll Liabilities tool, generates a report of all the manual check transactions coded to a Payroll Tax vendor.